In the Agility Emerging Markets Logistics Index 2021, Vietnam moved three places up the rankings to 8th place overall. The country’s consistent economic growth over the past few decades as well as its recent success in controlling the spread of the Coronavirus has positioned it as a promising emerging market according to the 2021 Index.

In recent years, Vietnam has emerged as a very popular manufacturing location, especially for global companies determined to reduce the risk of producing exclusively in China. The country has recently positioned itself as a viable, cost-effective and proximate alternative to China for manufacturers looking to escape the growing costs of sourcing in China or fearing over-reliance on production there. Increasing levels of ‘optionalization’, as the trend has been termed, will continue to benefit Asian countries which are able to build out the necessary industrial eco-systems.

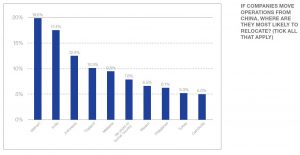

The survey found that once again Vietnam tops the ranking as the emerging market best placed to benefit from any shift away from China. Vietnam, along with India, which remains in second place, is rated as the best alternative option by meaningfully fewer respondents this year. Throughout the survey, respondents stress that China remains a vital supply chain location and that cost is an extremely important and complex calculation when determining geographic locations. While the vulnerabilities of overexposure to China have become more apparent during the Covid-19 pandemic, so too has the time, cost and complexity required to relocate.

The Vietnamese economy experienced its slowest rate of growth in 30 years – but still expanded by 2.9% in 2020, spurred by steady growth in manufacturing and processing. GDP is expected to grow 7% a year over the next five years. The country has benefitted from free trade agreements with the European Union and the UK, as well as Asia’s Comprehensive & Progressive Agreement for Trans-Pacific Partnership (CPTPP), which gives Vietnamese goods improved access to Canada and Mexico. Both before and during the pandemic, it has seen an influx of manufacturing and investment, including some from producers looking to relocate from China, some from neighbouring countries that could not reopen production lines amid the pandemic.

However, so rapid has the investment and arrival of new businesses been that it is creating challenges of its own. There is a shortage of skilled worker in the technology manufacturing sector, lack of industrial zone capacity with the outskirts of Ho Chi Minh City occupancy at 94% in 2020 and lack of local suppliers of components forces Vietnam to import materials, namely from China.

Further reasons for the success of Vietnam in this year’s Index lie with how the country dealt with the Coronavirus pandemic. It is among the countries most successful in containing the virus. The combination of social and economic restrictions in combination with a strict and comprehensive test and trace system, saw lockdowns last less than three months and less than 1,500 cases over 2020 (Johns Hopkins University), and by June many factories were reopened helping domestic operations recover quickly. Production and export capabilities were brought back online rapidly.

The Southeast Asian country’s entry into the Top 10 as well a boost of three places is due to its effectiveness in limiting the spread of the virus, how it positioned itself deftly to absorb manufacturers seeking to leave China and the fact possesses an enviable investment pipeline across a number of sectors, including fashion and electronics, which could see its rise continue in 2022. Addressing the skills, capacity and ecosystem challenges Vietnam faces will be vital or each threatens to arrest the country’s growth.

Source: Transport Intelligence, February 18, 2021

Author: Transport Intelligence

This brief has been taken from a larger paper, ‘Agility Emerging Markets Logistics Index 2021‘. The paper is available to GSCi subscribers. Each week, Ti’s team of senior analysts and industry experts deliver analysis covering the latest logistics and supply chain trends exclusively to users of GSCi.