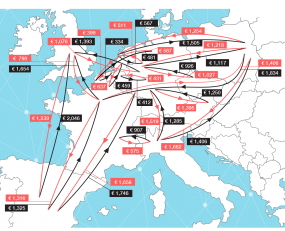

Ti and Upply’s European Road Freight Rate Benchmark Q3 2020 shows that rates have increased alongside the recovery in Europe’s economic activity.

With restrictions on everyday life gradually lifted into Q3, industry and retail saw a sharp uptick in volumes compared to the height of lockdowns. As a result, demand for international volumes quickly improved, pushing rates higher across nearly three quarters of trade lanes.

Carriers had initially reacted to the crisis by removing capacity from the market. They were able to take advantage of government job retention schemes to reduce the hours of drivers either entirely or just partially. With demand improving in Q3, capacity also returned to the market this quarter, keeping a lid on the increase in road freight rates.

The report investigates how the demand picture improvements have affected rates in individual countries, finding Germany to show the strongest correlation with the improving demand picture.

The recovery was seen clearly in the Duisburg-Warsaw lane, where rates improved by 2.7% against Q2, continuing a strong long-term upward trajectory. However, on Europe’s other major trade lanes, including Madrid-Paris and Lille-Duisburg, the picture was mixed.

As in previous iterations, the report looks at how prices vary by journey distance. In particular, three lanes; Paris-Birmingham, Duisburg-Birmingham and Duisburg-Milan, are investigated to understand why rates exceed the prices suggested by the curve of best fit.

Rates into and out of Europe’s major import and export hubs are also examined to see what the rate dynamics tell us about the recovery in Europe extra-regional trade volumes.

Finally, the report studies Duisburg-Vienna, which showed a particularly strong increase in rates in Q3, whilst looking ahead at Paris-Warsaw to consider whether or not it will see its normal peak season bounce.

Andy Ralls, Quantitative Analyst at Ti, commented, “The pace of recovery has been a key driver in the improvement in rates this quarter. It has also enabled road freight operators to increase capacity, which in turn has kept rates from rising much further. The market still does not resemble the pre-COVID ‘normal’ though, with uncertainty persisting. Carriers on thin margins will often seek to hold prices up in these circumstances.”

Thomas Larrieu, Upply’s Chief Data Officer, commented: “While volumes decreased by 60% in certain countries in April, we anticipate a lower impact of the second lockdown decided in several European countries, since more businesses remain open this time. For Q4 2020, we forecast flat prices and even increasing ones on certain corridors.”

About the European Road Freight Rate Benchmark

The European Road Freight Rate Benchmark report is designed to provide greater visibility of freight rate development across Europe. CLICK HERE to download the report

If you have any questions about the report please contact Michael Clover, Ti’s Head of Commercial Development – [email protected].

You can also join Ti and Upply for the European Road Freight Rate Development Benchmark Webinar, Wednesday 4th November 2020, 15:00 CET.

The Webinar will feature Thomas Larrieu, Upply’s Chief Data Officer; William Béguerie, Road Transport Expert at Upply; Andy Ralls, Quantitative Analyst at Ti; and Michael Clover, Ti’s Head of Commercial Development, discussing the data trends and drivers behind:

CLICK HERE to register for the webinar and we’ll send you your invitation to join the live webinar at 15:00 CET on Wednesday 4th November.

About Transport Intelligence (Ti): Ti is the world’s leading source of market intelligence for the logistics and road freight industry, providing data and analysis through its European Road Freight Transport report series, Global Supply Chain intelligence (GSCi) database and expert consultancy services. https://www.ti-insight.com

About Upply: Upply’s mission is to reset the fundamentals of the supply chain market to help each player unleash their potential. Upply directly connects road carriers to trusted shippers throughout France. They also enable supply chain professionals to overcome the volatility and inefficiency of the market though a set of data expertise solutions. Upply employs data scientists, logistics and IT professionals, and digital experts. Launched in November 2018, Upply is based in Paris. https://upply.com/en