Global Automotive Logistics 2023

Download today

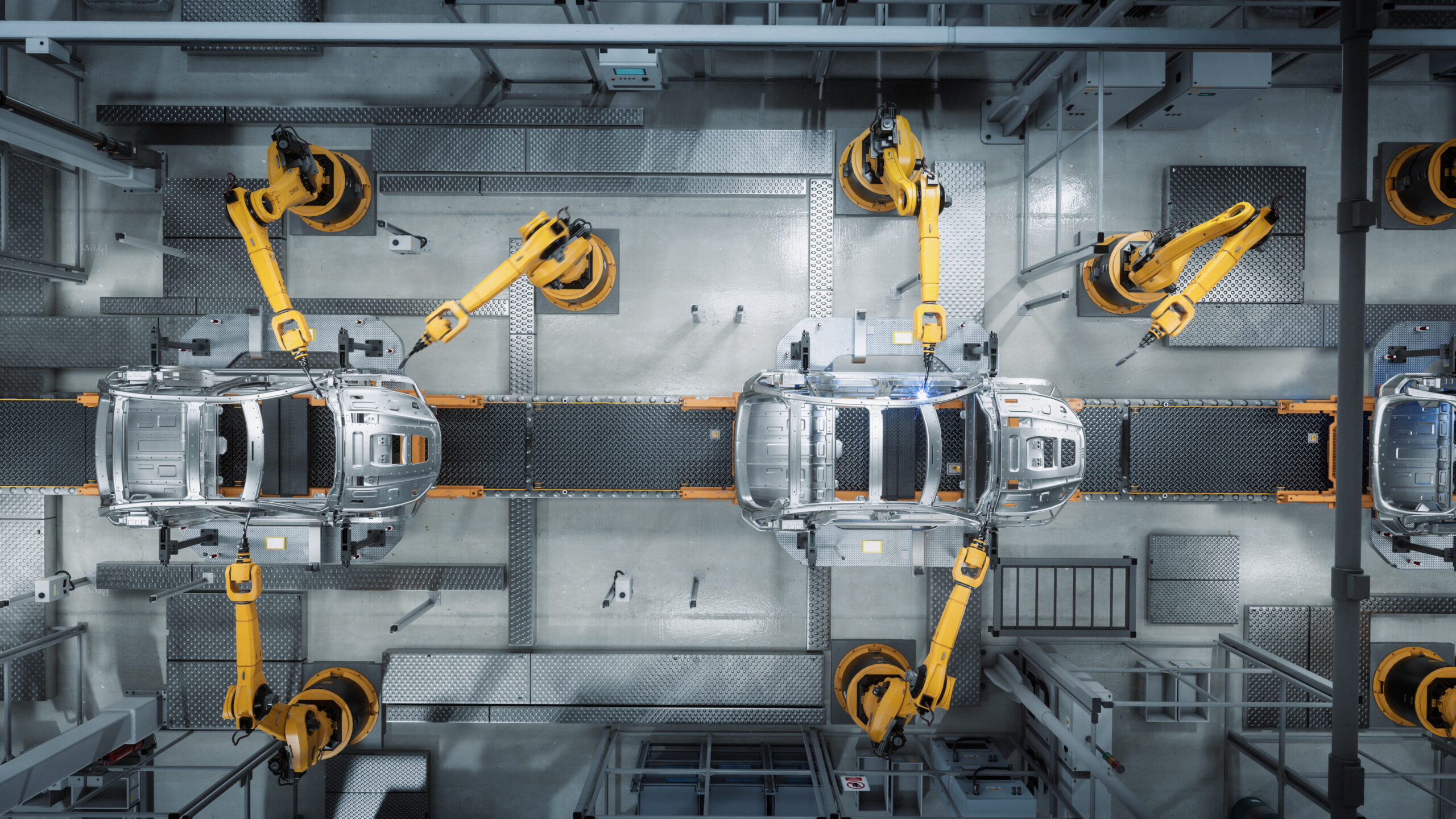

The global automotive logistics market remains highly unstable with fundamental change, emerging trends, technologies and legislation affecting all areas of the industry. Use our market report to understand market dynamics, growth trajectories, opportunities and challenges.

This report from Ti Insight provides a detailed analysis of the global automotive industry, including 2022, 2023 and 2027 market sizes and forecasts, segmentation data, trend analysis, comparative company profiles and provider profiles.

The report contains data taken from our online data platform GSCI which contains much more detail about the automotive market, companies and trends.

This report contains

- Automotive logistics market sizing & forecasts for 2022 and 2023, as well as the 2022-2027 CAGR

- Market segmentation (inbound, outbound and spare parts)

- Global and regional-level figures

- Market trend analysis

- Top automotive companies by revenue and company profiles

- Comparative automotive logistics service provider profiles

This report contains

- Automotive logistics market sizing & forecasts for 2022 and 2023, as well as the 2022-2027 CAGR

- Market segmentation (inbound, outbound and spare parts)

- Global and regional-level figures

- Market trend analysis

- Top automotive companies by revenue and company profiles

- Comparative automotive logistics service provider profiles

Key questions the report answers:

- How fast are regional and country automotive logistics markets growing? And how will the market perform out to 2027?

- How are the inbound, outbound and spare parts markets performing?

- What are the major factors affecting the automotive industry in 2023 and beyond?

- How will the proposed EU ban on the sale of new petrol and diesel cars impact the industry?

- Will the role of airfreight increase as the distances between supplier and customer increase and the weight-to-value of key components changes?

- Who were the top automotive logistics companies by revenue in 2022?

- Which providers have a strong position in the automotive logistics market and what are their core offerings?

- Who will be the winners and losers of the new technology vehicle supply chain?

- Will the EV automotive sector change its approach to air freight and adopt that seen in the electronics sector?

- How will key trends impact various automotive logistics segments?

- What strategies and technologies are the top automotive manufacturers adopting in response to the challenges faced within the industry?

Key findings:

- By the end of 2023, the global automotive logistics market is forecast to grow by 3.1%.

- The global automotive 2022-2027 CAGR is forecast to be 4.2%.

- The global spare parts market grew 6.8% in 2022 and is expected to grow another 2.3% in 2023.

- Inventory will be managed in a very different manner, with a move away from traditional concepts such as ‘just-in-time’.

- China has seen an explosion in EV production and has increased exports fivefold, changing the nature of international trade in passenger vehicles.

- The shift to new propulsion systems is the dominant development in the automotive sector alongside the emergence of digital guidance systems.

- Given the nascent and evolving nature of battery supply chains, vehicle manufacturers are adopting different approaches to their development.

- Battery supply chains are changing rapidly and ‘legacy’ vehicle manufacturers are investing in dedicated battery production.

- The violent shift in technology is already visible and supply chain geographies are rapidly changing as manufacturers attempt to locate semiconductor production approximate to assembly plants.

|

Summary 2 Introduction 3 Table of contents 4 Table of figures 5 1. Market Sizing 6 1.1 GLOBAL 6 1.2 SUB-SECTORS: INBOUND, OUTBOUND AND SPARE PARTS 11 2. Market Trends 20 2.1 CHANGING STRUCTURE OF SUPPLY CHAINS 20 2.2 INTEGRATED CIRCUITS 21 2.3 EV EXPLOSION 22 2.4 CHANGING SUPPLY CHAIN GEOGRAPHY 27 3. Automotive Company Profiles 28 3.1 VOLKSWAGEN 29

|

3.2 STELLANTIS 29 3.3 TOYOTA 31 3.4 BMW 33 3.5 FORD 35 3.6 NISSAN 37 3.7 TESLA 38 3.8 GM 39 3.9 VOLVO 40 3.10 DAIMLER AG 41 4 Automotive Logistics Service Providers 43 4.1 CEVA 44 4.2 DB SCHENKER 46 4.3 MAERSK GROUP 47 About Ti 48 License and copyright 49

|

Power shifts to semi-conductor manufacturers

- China sees explosion in EV production and increased exports fivefold

- The global spare parts market grew by 6.8% in 2022

- VW was the largest vehicle manufacturer by market value in 2022, at €279232m

25th July, 2023 Bath, UK – The Global Automotive Logistics 2023 Report from Ti Insight shows market instability, major supply chain shifts and offers insight on vehicle manufacturer activity.

A lack of coordination between vehicle manufacturers and semi-conductor manufacturers is causing a major shift in the balance of power between the supplier and the supplied. That’s according to the Global Automotive Logistics 2023 Report from Ti Insight, a 40-page document which includes automotive trends, analysis, market sizing, forecasts, manufacturer case studies and an overview of selected automotive logistics service providers.

“The past five years have been a period of remarkable instability in the automotive sector Worldwide,“ explains Senior Editor Julia Swales. “The impact of the supply chain crisis of 2020-2022 was extreme, with large falls in production volumes of a magnitude that have not been seen for at least the past decade. The implications for the logistics sectors serving the automotive sector have been severe.”

The Global Automotive Logistics 2023 Report from Ti Insight – the leading provider of market research to the global logistics industry – shows that the violent shift in technology is already visible and supply chain geographies are rapidly changing as manufacturers attempt to locate semiconductor production approximate to assembly plants.

Report Highlights:

- By the end of 2023, the global automotive logistics market is forecast to grow by 3.1%.

- The global automotive 2022-2027 CAGR is forecast to be 4.2%.

- The global spare parts market grew 6.8% in 2022 and is expected to grow another 2.3% in 2023.

- Inventory will be managed in a very different manner, with a move away from traditional concepts such as ‘just-in-time’.

- China has seen an explosion in EV production and has increased exports fivefold, changing the nature of international trade in passenger vehicles.

- The shift to new propulsion systems is the dominant development in the automotive sector alongside the emergence of digital guidance systems.

- Given the nascent and evolving nature of battery supply chains, vehicle manufacturers are adopting different approaches to their development.

- Battery supply chains are changing rapidly and ‘legacy’ vehicle manufacturers are investing in dedicated battery production.

- The violent shift in technology is already visible and supply chain geographies are rapidly changing as manufacturers attempt to locate semiconductor production approximate to assembly plants.

- The balance of power has changed between semi-conductor manufacturers and vehicle manufacturers without the vehicle manufacturers sufficiently understanding the consequences.

- BMW is deploying trucks powered by CO2-neutral, second-generation biofuels and testing and implementing hydro-treated vegetable oil (HVO) with its logistics partners.

The report – written by industry researchers, analysts and associates ̶ is one of several reports published each month by the Ti team, utilising data from its GSCI knowledge portal, a data powerhouse with over 1million pieces of data and analysis.

For photos, an interview or further comment please email [email protected]

This report is perfect for

- Global manufacturers

- Banks and financial institutions

- Supply chain managers and directors

- Logistics procurement managers

- Marketing managers

- Knowledge managers

- Investors

- All C-level executives