August 12th, London, UK: For August, Logistics confidence improved slightly, but remained negative.

Within air freight, one of the most significant events over the last month was the agreement between IATA and FIATA to jointly manage international air cargo regulations through the IATA-FIATA Governance Board (IFGB). The Board replaces the existing IATA Cargo Agency Program, and in doing so, demonstrates how the balance of power between forwarders and carriers has shifted over the years.

Positive news for those operating in the market came with the release of global air cargo figures for June. According to IATA, global freight tonne kilometres increased by 4.3% year on year, trailing available freight tonne kilometres by 0.6 percentage points, but nonetheless indicating significant demand in the market.

With regards to the global containerized shipping industry, the demand picture does not appear nearly as healthy. Industry analyst Drewry has projected record vessel scrapping for 2016, with container lines racing to slash capacity in order to address the mismatch between supply and demand that has defined the industry for so long.

As to the ships that remain, container lines are rationalizing their services. This was displayed recently by the news that Maersk Line is to cease feeder services to 10 Chinese ports, in order to focus on more profitable business.

Carriers are suffering from extremely low freight rates this year, to the extent that even the aforementioned Maersk, which is the largest, suffered net losses of $114m for the first six months of the year. Other prominent carriers to report losses over this timeframe include OOCL and Hapag Lloyd, with each attributing the financial results to an average revenue decline of around 20% per TEU.

Air freight

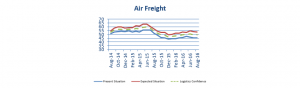

The air freight Index sank further below the 50-point mark in August, falling by 0.4 points month on month, by 5.1 points year on year and 3.6 points against the total for August 2014.

The August results for the present air freight Index were characterised by a month on month decline of 0.3 points to 45.2. Whilst the Asia to Europe lane registered a 0.6 point rise to 46.5, this was the only increase exhibited amongst the four lanes. US to Europe was unchanged from July at 45.1, whereas Europe to Asia fell by 1.0 points to 42.9 and Europe to US declined by 0.6 points to 46.6.

The logistics expectations Index for air freight remained in positive territory, but fell by 0.5 points to 53.2. Again, the Asia to Europe lane bucked the trend, with a 0.2 point increase against July to total 55.7. Moreover, Europe to US rose by 1.0 points to 52.9. These results were offset, however, by heavy declines in US to Europe, which fell 1.6 points to 54.3, and Europe to Asia, which fell below the 50-point mark to 49.6, having declined by 1.9 points.

Sea Freight

The August sea freight logistics confidence Index rose by 0.5 points from July, amounting to 48.4. The improvement was driven by a 1.7 point increase in the present Index over this timeframe.

Nonetheless, standing at 44.0, the present Index remained in negative territory. Growth was recorded in all lanes bar Europe to US, which lost 1.3 points to 46.2. US to Europe, by contrast, improved by 3.8 points to 42.0. Meanwhile, Asia to Europe increased 3.4 points to 48.5, and Europe to Asia rose 0.3 points to 38.7.

The expected Index totalled 52.8 for August, having lost 0.6 points compared to the previous month. Though Europe to US and US to Europe both improved by 1.0 points, to 56.1 and 51.8 respectively, declines in the other lanes offset this growth. Europe to Asia fell below the neutral mark with a 1.4 point decline to 48.7, whilst Asia to Europe displayed a 2.5 point fall to 54.7.

One-Off Question

For the August one-off question, the survey cited the recent UK referendum on EU membership, which resulted in a vote to leave. The question asked respondents how they expected this result to impact their European import and export volumes.

There was no majority response, though 39.3 percent of participants stated they expected a negative impact, compared to 8.0 percent who anticipated a positive impact. Nonetheless, a large portion of survey participants (36.6 percent) predicted that the UK’s decision to leave the EU will have a negligible impact upon their volumes.

Of the remaining respondents, 12.5 percent were unsure of the impact, whilst 3.6 percent considered alternative answers to the question. For example, one participant foresaw a negative impact initially, followed by a long term positive impact.