The German air freight sector remains in the slow lane. Its two largest actors, Fraport and Lufthansa, have just reported their annual numbers and whilst both are profitable the underlying picture was muted, implying mixed prospects for their cargo operations.

At a superficial level, Fraport had a tremendous year. Although revenue fell by 0.5% to €2.58bn, profits measured in terms of EBITDA leapt by 24% to €1bn, whilst EBIT was up by 33% to €693m. However, much of the increase was driven by compensation payments for problems at its new Manila airport development, as well as sales of assets. The Manila payment alone amounted to €198m. Stripping these sums out of the results would have resulted in roughly flat operational profit figures. Cargo growth, in terms of tonnage, was moderate at 1.8%; 2.1m tonnes. Fraport said that they expected cargo operations to show a higher rate of growth next year, possibly in excess of 3%.

Lufthansa, which is Fraport’s largest single customer, saw better figures than the expected sharp decline for the 2016 financial year. Revenue edged down by 1.2% to €31bn and EBIT was up by 35%, to €2.27bn. The profit figure was, however, flattered by the effects of pension costs and strikes, with the underlying figure seeing a fall of 3.6%. Passenger demand was mixed with Lufthansa generally relying on improvements in its cost base, rather than higher passenger volumes to manage profits.

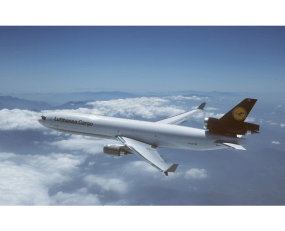

However, Lufthansa Cargo fell into a loss of €50m on revenue, down 11.5% at €2bn, due to what the airline describe as “significant pricing declines in particular in the face of massive overcapacities”. Lufthansa Cargo continued to reduce the size of its fleet over the year, shedding a further two freighters.

Both businesses are fighting against continuing mediocre growth in world trade combined with structural problems in air cargo demand. In the short-term this may be relieved by less capacity on the market, however, it is far from certain that this will be sustained.

Source: Transport Intelligence, March 21, 2017

Author: Thomas Cullen