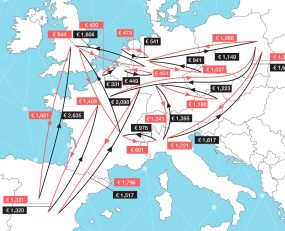

Ti and Upply’s European Road Freight Rate Benchmark Q2 2021 shows prices are being pushed up due to rising demand levels and supply chain disruption.

In spite of ongoing pandemic-related disruption, economic activity levels continued to improve in the second quarter. Vaccine roll-outs are enabling governments to reopen their economies, whilst the rebound in consumption after the first wave of the pandemic remains strong. In its Summer Forecast, the European Commission sharply upgraded its GDP forecast for the EU to 4.8% from 4.2% in the Spring. This situation is leading to a positive development in road freight demand levels, leading to upward pressure on rates.

Supply chain disruption is increasingly influencing road freight rates. Due to a shortage of semiconductors, manufacturing production growth is slowing in some areas. This is dampening the rate momentum on certain lanes, such as Warsaw-Duisburg. Meanwhile, congestion in Northern European ports appears to be increasing turnaround times for hauliers, which looks to be being priced in by carriers. On Duisburg-Rotterdam, rates grew 5.3% quarter-on-quarter.

UK supply chains are showing more acute signs of strain. Rates remain elevated after their jump in Q1 due to the administrative burden around new trade rules. The loss of EU hauliers due to new immigration rules has served to squeeze capacity further. The UK’s outbound lanes, which are generally lower priced and in which goods are subject to more stringent EU import checks, are where the added disruption is being priced in.

Andy Ralls, Senior Quantitative Analyst at Ti, commented, “The strong recovery in economic activity and supply chain disruption are the key drivers pushing rates higher. Over the coming months, demand levels are likely to increase, although perhaps less sharply than in Q2. In terms of disruption, some short term issues might subside, such as a shortage of transport equipment and intermediate goods. However, issues such as driver shortages remain problematic over the longer term. These pressures are likely to keep rates high over the remainder of 2021.”

Thomas Larrieu, Upply’s Chief Data & Research Officer, commented: “For the end of the year, the European road transport market will most certainly remain under pressure. The increase in demand in Europe in Q3 and Q4 2021 with Black Friday and the festive season will certainly push up transport prices in a market where capacity will be in high demand. Terminal congestion may lead to even higher and more volatile rates on routes from European ports. However, the impact of the Delta variant could change the scenarios in case of further drastic restrictions..”

Source: Transport Intelligence, August 3, 2021

Author: Transport Intelligence

About the European Road Freight Rate Benchmark

The European Road Freight Rate Benchmark report is designed to provide greater visibility of freight rate development across Europe. It will be available to download from Wednesday 4th August.

You can also join Ti and Upply for the European Road Freight Rate Development Benchmark Webinar, Wednesday 4th August 2021, 15:00 CEST. All registrants for the webinar will also be sent a free copy of the benchmark report.

The Webinar will feature Thomas Larrieu, Upply’s Chief Data Officer; Boris Pernet, CEO for Upply; Andy Ralls, Quantitative Analyst at Ti; and Michael Clover, Ti’s Head of Commercial Development, discussing the data trends and drivers behind:

CLICK HERE to register for the webinar at 15:00 CEST on Wednesday 4th August.

CLICK HERE to download a copy of the full benchmark report.

If you have any questions about the report please contact Michael Clover, Ti’s Head of Commercial Development – [email protected].