2016 has been the weakest year for the global economy since the Great Recession of 2008-09. 2016 has been the weakest year for the global economy since the Great Recession of 2008-09. That is the clear and simple message of the World Bank’s most recent Global Economic Prospects report. Global economic growth was just 2.3% in 2016, down from 2.7% in 2015. Weak US performance and recessions in large commodity-dependent economies curtailed growth. In emerging markets, the disparity between growth of commodity exporting nations compared to importing nations was vast:

GDP growth in emerging markets

The struggles of commodity exporters’ overall economic growth are thought to have spilled over and negatively affected their logistics sectors. This is apparent in the findings of the forthcoming Agility Emerging Markets Logistics Index 2017 report, due to be released later this month, which features a composite index that ranks emerging markets based on their logistic industry prospects. Index scores and rankings of several major commodity exporters have suffered while importers have been far more resilient.*

Looking ahead, some of the World Bank’s key expectations for 2017 are:

• Global growth is projected to rise from 2.3% in 2016 to 2.7% in 2017. However there is substantial uncertainly around this baseline figure. The World Bank asserts there is a 50% chance that actual growth will be between 2.0% and 3.2%.

• Political uncertainty (largely associated with Brexit and Donald Trump) has been identified as a key risk which could curtail growth in 2017.

• On the other hand, possible fiscal stimulus, especially in the US, represents a substantial upside risk to the outlook.

• Rising oil prices are expected to help boost three leading commodity exporters – Brazil, Russia and Nigeria – from recession in 2017. However metals and agriculture commodity prices overall are expected to remain more or less flat to 2019.

• World trade volume growth was just 2.5% in 2016. It is expected to increase to 3.6% in 2017. Although new trade restrictions reached a post-crisis high in 2016, encouragingly, most emerging markets “still have a large untapped potential to move up the value chain, by shifting to more complex and higher domestic value-added products”.

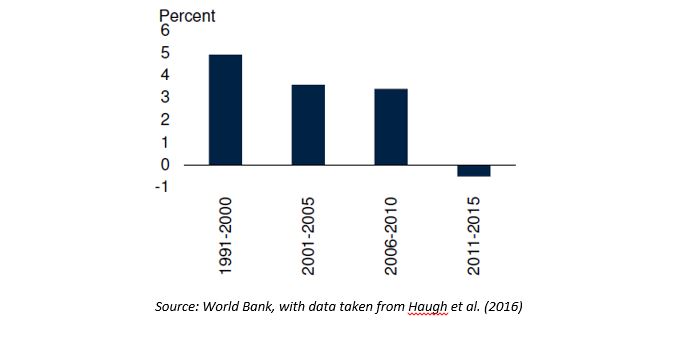

My main takes regarding the logistics industry are first, that unsurprisingly, the expectation of slightly higher economic growth in 2017 is good news, but don’t count in any way on the global economy to deliver a more favourable environment in 2017 than in 2016, as more uncertainty surrounds these forecasts than in previous years. Ditto for world trade growth. And finally, it is quite possible that growth in global ‘supply chain complexity’ has slowed down significantly over the last five years or so – not good news for logistics providers, especially forwarders. Although growth in supply chain complexity encompasses all manner of considerations, one possible proxy for it is growth in global value chains. Global value chains measure the extent to which production processes are fragmented across countries – the iPhone contains parts from at least 10 different countries. It seems that growth in fragmentation of production has slowed significantly since 2010, and it does not appear that it will pick up to rates seen in years past.

Global value chain growth

*Many of the forward-looking issues that the World Bank’s Global Economic Prospects report addresses are also questions that have been asked of over 800 supply chain and logistics executives in the upcoming Agility Emerging Markets Logistics Index 2017 survey. For example: How will economic growth in emerging markets fare in 2017? What do you think will be the most significant drivers of the global economy in 2017? How concerned are you about growing protectionism and moves away from free trade? For the logistics industry’s take on global economic prospects and to receive a copy of the report upon publication, register your interest here.

*Many of the forward-looking issues that the World Bank’s Global Economic Prospects report addresses are also questions that have been asked of over 800 supply chain and logistics executives in the upcoming Agility Emerging Markets Logistics Index 2017 survey. For example: How will economic growth in emerging markets fare in 2017? What do you think will be the most significant drivers of the global economy in 2017? How concerned are you about growing protectionism and moves away from free trade? For the logistics industry’s take on global economic prospects and to receive a copy of the report upon publication, register your interest here.

Source: Transport Intelligence, January 11, 2017

Author: David Buckby