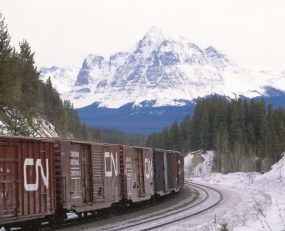

Canadian National (CN) has announced its full year and fourth quarter (Q4) results for 2016. Revenue in Q4 was up 1.6% on of the same period in 2015, but revenue for the year was down overall by 4.6% to C$12.0bn.

EBITDA was up 2.4% on the previous year to C$6.6bn. CN also announced record operating income in Q4 of C$1.0bn. This was attributable to a rebound in revenue streams in the final quarter from grains, petroleum products and finished vehicles; as well as freight rate increases.

Volume statistics were released segmented by vertical sectors. Carloads of coal reduced 24.0% from 2015, though the effects of this were small as coal only accounted for 7.9% of total volume in the previous year. Automotive volumes were up 8.3%, but all other sectors (petroleum & chemicals, metal & materials, forest products, grain & fertilizers and intermodal) saw a decrease in carloads over the year. This led to a year-on-year volume decrease of 5.1%, though in Q4 volume increased by 3.3% against Q4 of 2015.

CN saw lower volumes of crude oil, coal and frac sand; as well as lower fuel surcharge rates as reasons for the decrease in revenue over the year. However, these were partially offset by the weaker Canadian dollar and freight rate increases.

Luc Jobin, President and CEO of CN said: “Despite facing difficult winter conditions in December, CN delivered very strong fourth-quarter results.”

Looking ahead to 2017, Jobin added: “Overall, the economy remains challenging, but we remain optimistic and expect to see moderate volume growth in 2017.”

Source: Canadian National