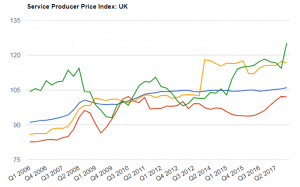

Ti’s dashboard on GSCi tracks the UK’s Office for National Statistics’ Service Producer Price Index (SPPI). This provides quarterly data on price changes for the UK’s major service industries.

The latest SPPI shows a 0.2% quarter-on-quarter increase in Q4, and a 1.4% increase in 2017 overall. These price increases mirror the situation in the wider economy, although to a lesser extent, with uncertainty surrounding Brexit and the pound’s devaluation leading to inflation of around 3%.

Across all sectors, transportation and storage services provided the largest upward contribution to the SPPI’s quarterly and annual rate, accounting for 0.18 and 0.43 percentage points respectively. The Q4 quarter-over-quarter percentage change in transportation and storage costs was 0.7% and the annual change was 2.1%.

Breaking this down into freight-related areas, there was a 0.6% increase in road freight transport prices in 2017. Freight forwarding rates were up 6.4%, whilst vehicle ferries and sea/coastal freight figures were up 2.4% and 1.5% respectively.

![]()

![]()

The increase in freight forwarding rates are unsurprising given the global trend through 2017. However, they do buck the recent trend in the UK. Although the last six quarters have shown price increases, this followed 10 consecutive quarters of decreases. Global undercapacity in airlines and soaring volumes, with particularly strong growth in e-commerce, helped lead an increase in global freight rates. IATA’s estimated global cargo yield increase was 5% in 2017. Similarly, in sea, rates were much higher. Maersk for example registered an 11% increase in freight rates in the year. Despite its uncertain market conditions, the UK was not immune from the pickup in global trade, nor was it immune to undercapacity.

Road freight price increases were relatively low and on the face of it, this was slightly surprising. The most significant costs in this industry are fuel and driver-related, both accounting for approximately one third of costs. The UK has a growing driver shortage problem and estimates by the Freight Transport Association suggest the shortfall is nearly 55,000. The rising oil price also suggests an upward movement in prices. However, the average price of diesel in the UK only grew by 0.7% in 2017, whereas in Germany, France, Italy and Spain, the increases were 7.5%, 11.4%, 7.7% and 8.6% respectively.

Volatility in bunker fuel price between countries is less pronounced. Price dynamics between commercial vehicle ferries and sea/coastal water freight are broadly quite similar, which means that their price increases were not too dissimilar in 2017.

The factors affecting prices are not easily quantifiable or forecastable but there are some observations that can be made. After a strong bounce back for global trade in 2017 it would be surprising if freight forwarding rates were to increase by as much as they did in 2017, particularly as export orders have slowed down in the past few months. The oil price has shown a steady rise into 2017, which has been matched by an increase in UK diesel prices. Finally, the UK’s driver shortage issues could have an impact on prices in future, particularly if concerns about the status of European drivers after Brexit are not adequately addressed.

Source: Transport Intelligence, April 12, 2018

Author: Andy Ralls

For more industry-wide data, as well as information on key providers, markets, vertical sectors and geographies, please visit Ti’s new Global Supply Chain Intelligence platform.